UK office landlords could be set to spend up to £63bn to meet new energy standards

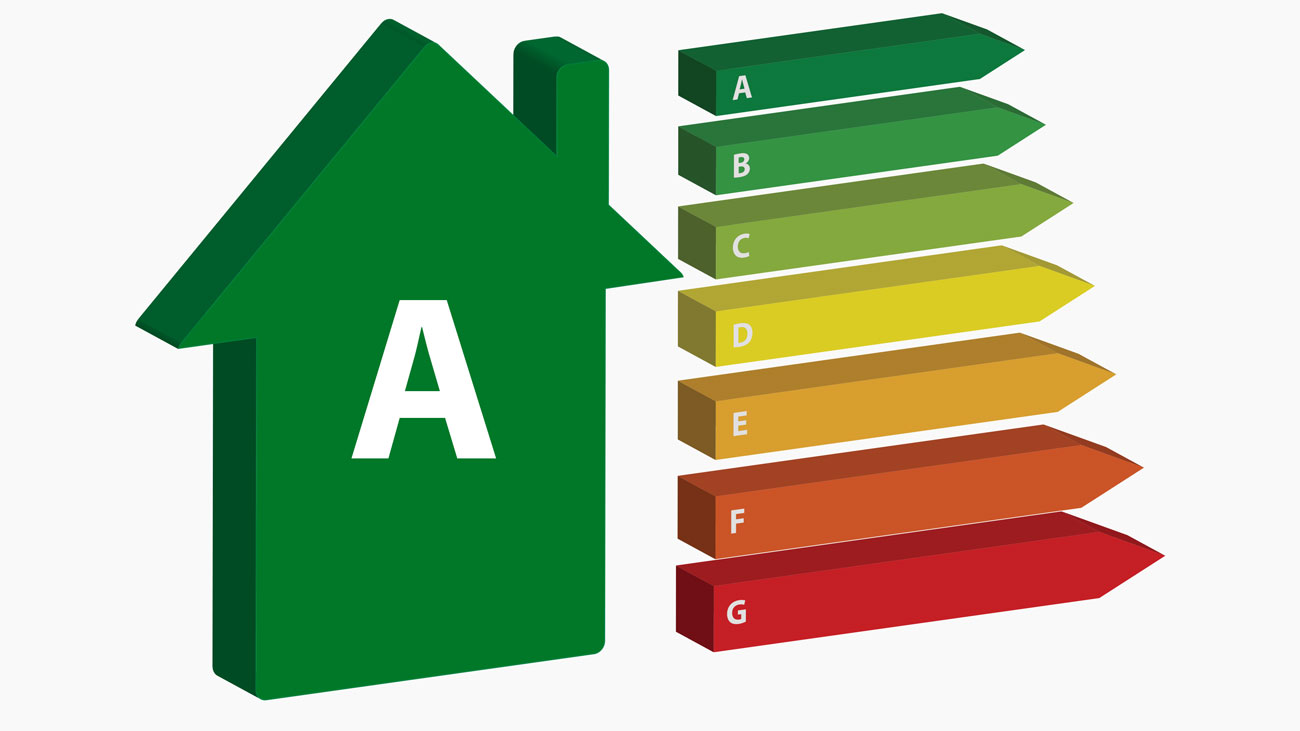

According to new research by Savills it could cost UK landlords upwards of £40 per sq ft (£430 per sq m) to make high cost improvements in order to hit proposed legislative energy targets set to come into effect from 2027 onwards. There are currently a number of significant legislative changes under consultation that will see all commercial rental buildings requiring an in-date EPC lodged on the national register by 2025. By 2027 a minimum EPC Grade ‘C’ rating will be needed in order to receive any further rent from tenants or to re-let a property, with a Grade ‘B’ required by April 2030 onwards.

Buildings are responsible for approximately 40% of energy consumption and 36% of CO2 emissions in the EU. Whilst some new buildings might be designed to good energy-efficient standards, utilising new technology that reduces waste and saves energy, much of the UK’s building stock is less efficient. In order to comply with worldwide targets to reduce the impact of climate change, buildings need to become more efficient.

Savills research shows that at present 85% of office stock in the major UK office markets is rated an EPC ‘C’ or below, whilst 800 million sq ft is below the proposed minimum EPC ‘B’ rating. Based on the indicative cost modelling to make the required improvements, it is set to cost UK landlords as much as £63bn to reach EPC targets across key cities including London, Birmingham, Bristol, Edinburgh, Glasgow, Leeds and Manchester over the next eight years.

Mat Oakley, head of commercial research at Savills, comments:

“In 2021 we saw more than 90% of leasing activity being for the best quality office accommodation in some locations. This is clearly a sign that tenants are looking for prime space with good ESG credentials. The supply of such space is limited across the UK, with only around 10% of office buildings having an EPC rating of B or above. This should mean that rental pressure will remain upwards on high quality offices, and thus justify the spend on bringing secondary stock up the EPC ladder in most major office markets.”

Whilst every asset is different and will require different levels of intervention in order to make the required changes, there are typical enhancements that can be made to improve most buildings. This might include the use of LED lighting, the removal of gas in favour of electricity (increasingly from renewable sources) and smart energy metering.

Jack Pugh, director in the building and project consultancy team, adds:

“At present the average EPC rating for a commercial building in the UK stands at Grade ‘D’, meaning a significant proportion of existing building stock will be impacted by the proposed change of regulations. As a landlord with stock below a ‘B’ rating, it is important to take the opportunity to work on that building ahead of proposed deadlines and undertake improvements to obtain at least a Grade ‘B’ in order to future-proof the asset wherever possible. What’s clear is that legislation will only tighten in the coming years, and operational energy consumption will be increasingly scrutinised, which will force the industry to take action; it is therefore crucial to get ahead in order to make the required improvements on your own terms.”

Chris Cummings, Savills Earth director, says:

“EPC targeting is essential but can only be viewed as near-term compliance. We know that how EPCs are calculated will be updated in the coming years and the Government has already begun the process that will see Energy Use Intensity (EUI) eventually take over as the preferred metric for demonstrating MEES compliance. EPCs are not perfect but there is no better metric at present, focussing on the long term transition to net zero is the only way to safeguard against changing legislation and regulation. By taking action now, landlords can get ahead and make the required improvements on their own terms.”

This article first appeared at Savills.com and is reproduced with kind permission.